Industry News

Industry News

If you love investing in stocks youвҖҷre bound to buy some losers. But long term NRB Industrial Bearings Limited(NSE:NIBL) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 55% decline in the share price in that time. ItвҖҷs down 2.4% in the last seven days.

NRB Industrial Bearings isnвҖҷt a profitable company, so it is unlikely weвҖҷll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. ThatвҖҷs because itвҖҷs hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, NRB Industrial Bearings saw its revenue grow by 13% per year, compound. ThatвҖҷs a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 23% compounded, over three years. To be frank weвҖҷre surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

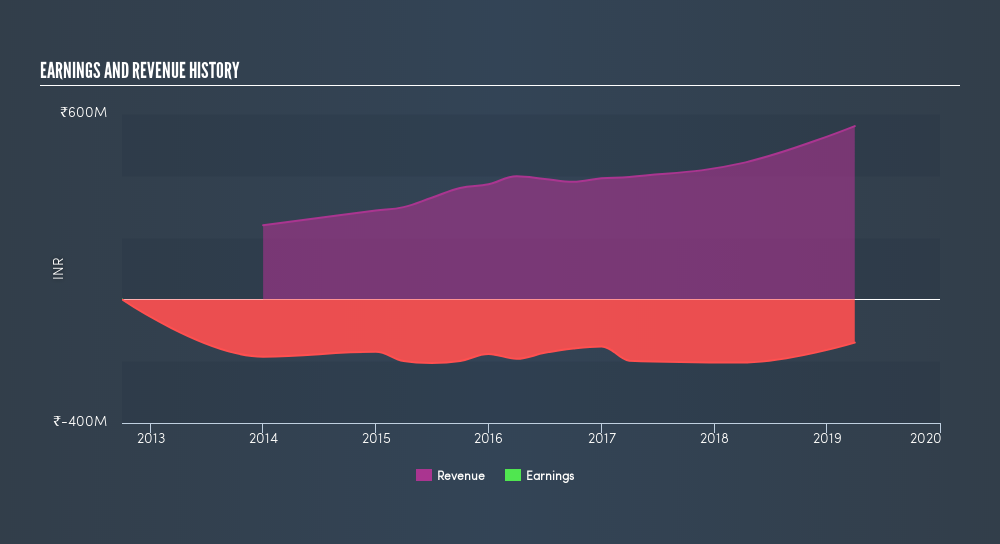

Depicted in the graphic below, youвҖҷll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Investors in NRB Industrial Bearings had a tough year, with a total loss of 9.1%, against a market gain of about 0.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldnвҖҷt be so upset, since they would have made 6.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering.