William Blair reiterated their outperform rating on shares of RBC Bearings (NASDAQ:ROLL) in a report published on Friday, May 24th, RTT News reports. William Blair also issued estimates for RBC Bearings’ Q1 2020 earnings at $1.22 EPS, Q2 2020 earnings at $1.22 EPS, Q3 2020 earnings at $1.40 EPS and Q4 2020 earnings at $1.60 EPS.

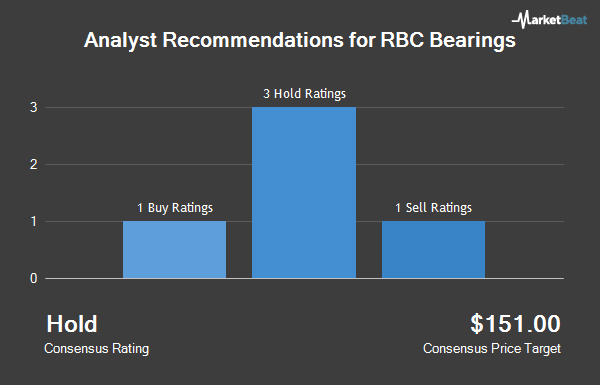

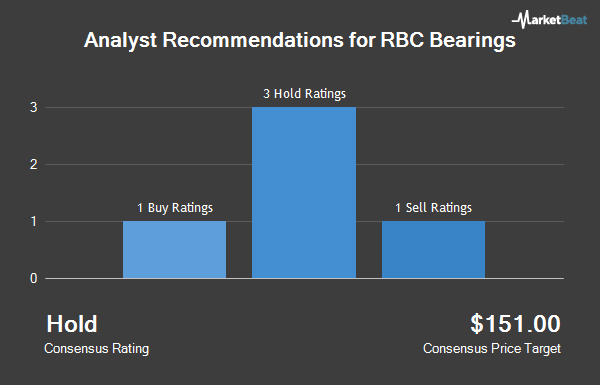

ROLL has been the subject of a number of other research reports. BidaskClub raised RBC Bearings from a sell rating to a hold rating in a research report on Friday, May 10th. Zacks Investment Research raised RBC Bearings from a sell rating to a hold rating in a research report on Wednesday, April 10th. Finally, ValuEngine downgraded RBC Bearings from a buy rating to a hold rating in a research report on Friday, March 22nd. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and two have given a buy rating to the company’s stock. The stock presently has an average rating of Hold and a consensus target price of $161.33.

ROLL stock traded down $1.15 during midday trading on Friday, hitting $149.23. 75,349 shares of the stock were exchanged, compared to its average volume of 103,768. The stock has a market cap of $3.70 billion, a PE ratio of 30.83, a P/E/G ratio of 4.78 and a beta of 1.24. RBC Bearings has a fifty-two week low of $123.50 and a fifty-two week high of $169.84. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.87 and a current ratio of 5.58.

RBC Bearings (NASDAQ:ROLL) last issued its quarterly earnings data on Thursday, May 23rd. The industrial products company reported $1.33 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.22 by $0.11. RBC Bearings had a return on equity of 13.01% and a net margin of 14.97%. The firm had revenue of $182.20 million during the quarter, compared to analysts’ expectations of $180.76 million. During the same period in the previous year, the firm posted $1.08 earnings per share. RBC Bearings’s revenue was up 1.3% on a year-over-year basis. As a group, equities research analysts predict that RBC Bearings will post 5.31 earnings per share for the current year.

In other news, VP Patrick S. Bannon sold 1,693 shares of the company’s stock in a transaction dated Tuesday, June 4th. The stock was sold at an average price of $147.00, for a total value of $248,871.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Thomas J. Obrien sold 2,500 shares of the company’s stock in a transaction dated Wednesday, March 27th. The stock was sold at an average price of $126.19, for a total value of $315,475.00. The disclosure for this sale can be found here. In the last three months, insiders have sold 6,693 shares of company stock valued at $882,721. 3.10% of the stock is owned by company insiders.

Hedge funds and other institutional investors have recently modified their holdings of the company. Marshall Wace North America L.P. acquired a new position in shares of RBC Bearings in the first quarter worth about $678,000. Marshall Wace LLP acquired a new position in shares of RBC Bearings in the first quarter worth about $714,000. Clearbridge Investments LLC lifted its stake in shares of RBC Bearings by 66.4% in the first quarter. Clearbridge Investments LLC now owns 196,398 shares of the industrial products company’s stock worth $24,976,000 after acquiring an additional 78,378 shares in the last quarter. GYL Financial Synergies LLC acquired a new position in shares of RBC Bearings in the first quarter worth about $895,000. Finally, Advisory Services Network LLC lifted its stake in shares of RBC Bearings by 20.8% in the first quarter. Advisory Services Network LLC now owns 697 shares of the industrial products company’s stock worth $89,000 after acquiring an additional 120 shares in the last quarter. 97.00% of the stock is owned by institutional investors.

About RBC Bearings

RBC Bearings Incorporated manufactures and markets engineered precision bearings and components in North America, Europe, Asia, and Latin America. It operates in four segments: Plain Bearings, Roller Bearings, Ball Bearings, and Engineered Products. The Plain Bearings segment produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings that are primarily used to rectify inevitable misalignments in various mechanical components, such as aircraft controls, helicopter rotors, or in heavy mining and construction equipment.

Industry News

Industry News