Industry News

Industry News

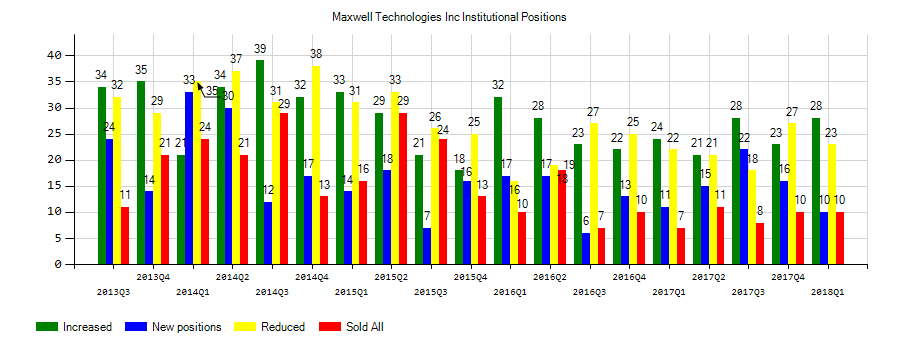

Maxwell Technologies Inc (MXWL) investors sentiment increased to 1.15 in 2018 Q1. It’s up 0.10, from 1.05 in 2017Q4. The ratio is more positive, as 38 institutional investors increased and opened new positions, while 33 sold and trimmed stakes in Maxwell Technologies Inc. The institutional investors in our database now have: 19.01 million shares, up from 18.15 million shares in 2017Q4. Also, the number of institutional investors holding Maxwell Technologies Inc in top ten positions was flat from 1 to 1 for the same number . Sold All: 10 Reduced: 23 Increased: 28 New Position: 10.

Analysts expect RBC Bearings Incorporated (NASDAQ:ROLL) to report $1.03 EPS on August, 2 before the open.They anticipate $0.12 EPS change or 13.19% from last quarter’s $0.91 EPS. ROLL’s profit would be $24.83M giving it 33.89 P/E if the $1.03 EPS is correct. After having $1.08 EPS previously, RBC Bearings Incorporated’s analysts see -4.63% EPS growth. The stock increased 0.97% or $1.34 during the last trading session, reaching $139.62. About 59,241 shares traded. RBC Bearings Incorporated (NASDAQ:ROLL) has risen 23.27% since July 23, 2017 and is uptrending. It has outperformed by 10.70% the S&P500. Some Historical ROLL News: 19/04/2018 – DJ RBC Bearings Incorporated, Inst Holders, 1Q 2018 (ROLL); 02/05/2018 – Wells Fargo Advisors LLC Exits Position in RBC Bearings; 30/05/2018 – RBC BEARINGS INC – BACKLOG, AS OF MARCH 31, 2018, WAS $392.1 MLN COMPARED TO $354.1 MLN AS OF APRIL 1, 2017; 30/05/2018 – RBC Bearings Fourth-Quarter Profit Rises 24%; 22/03/2018 – RBC Bearings Closes Below 50-Day Moving Average: Technicals; 21/03/2018 Investor Expectations to Drive Momentum within JELD-WEN Holding, Nathan’s Famous, Aerie Pharmaceuticals, RBC Bearings, Malibu B

Investors sentiment decreased to 1.26 in Q1 2018. Its down 0.32, from 1.58 in 2017Q4. It dropped, as 14 investors sold RBC Bearings Incorporated shares while 54 reduced holdings. 28 funds opened positions while 58 raised stakes. 23.26 million shares or 1.35% less from 23.58 million shares in 2017Q4 were reported. Paloma Prtnrs Mngmt accumulated 3,100 shares. Wells Fargo And Mn has invested 0.02% of its portfolio in RBC Bearings Incorporated (NASDAQ:ROLL). Geode Capital Ltd Com has 0.01% invested in RBC Bearings Incorporated (NASDAQ:ROLL). Shine Inv Advisory Svcs Inc invested in 94 shares. Blackrock Inc has invested 0.01% in RBC Bearings Incorporated (NASDAQ:ROLL). Kayne Anderson Rudnick Investment Mngmt has invested 2.17% in RBC Bearings Incorporated (NASDAQ:ROLL). Guggenheim Lc accumulated 2,945 shares or 0% of the stock. Moreover, Teacher Retirement Sys Of Texas has 0% invested in RBC Bearings Incorporated (NASDAQ:ROLL). Janney Montgomery Scott Limited Liability Company holds 0.03% of its portfolio in RBC Bearings Incorporated (NASDAQ:ROLL) for 24,482 shares. Architects has invested 0% of its portfolio in RBC Bearings Incorporated (NASDAQ:ROLL). Pub Employees Retirement Association Of Colorado holds 0.13% or 157,066 shares in its portfolio. Bradley Foster And Sargent Ct stated it has 207,925 shares or 0.98% of all its holdings. Tiaa Cref Invest Ltd Company reported 65,034 shares or 0.01% of all its holdings. Moreover, Bancorp Of America Corp De has 0% invested in RBC Bearings Incorporated (NASDAQ:ROLL). Envestnet Asset owns 14,791 shares or 0.01% of their US portfolio.

RBC Bearings Incorporated manufactures and markets engineered precision bearings and components in North America, Europe, Asia, and Latin America. The company has market cap of $3.37 billion. It operates in four divisions: Plain Bearings, Roller Bearings, Ball Bearings, and Engineered Products. It has a 41.21 P/E ratio. The Plain Bearings segment produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings that are primarily used to rectify misalignments in various mechanical components, such as aircraft controls, helicopter rotors, or in heavy mining and construction equipment.

Another recent and important RBC Bearings Incorporated (NASDAQ:ROLL) news was published by Seekingalpha.com which published an article titled: “Tariffs should not ‘materially alter’ outlook for best industrials, analyst says” on July 16, 2018.

Since February 14, 2018, it had 0 insider buys, and 14 insider sales for $31.37 million activity. On Friday, July 6 the insider Faghri Amir sold $332,355. HARTNETT MICHAEL J also sold $3.51 million worth of RBC Bearings Incorporated (NASDAQ:ROLL) shares. On Monday, June 18 CROWELL RICHARD R sold $272,392 worth of RBC Bearings Incorporated (NASDAQ:ROLL) or 2,100 shares. Bannon Patrick S. sold $55,428 worth of RBC Bearings Incorporated (NASDAQ:ROLL) on Thursday, March 8. On Thursday, March 15 the insider Crainer Thomas C sold $624,590. $566,930 worth of RBC Bearings Incorporated (NASDAQ:ROLL) was sold by LEVINE ALAN B on Wednesday, February 14.

The stock increased 1.44% or $0.07 during the last trading session, reaching $4.92. About 126,582 shares traded. Maxwell Technologies, Inc. (MXWL) has declined 8.20% since July 23, 2017 and is downtrending. It has underperformed by 20.77% the S&P500. Some Historical MXWL News: 07/03/2018 – Eielson AFB: Corona returns to Maxwell AFB; 14/03/2018 – Maxwell Technologies Announces Date for 2018 Annual Meeting of Stockholders; 27/03/2018 – SEC ALSO CHARGES EX-MAXWELL TECH CEO DAVID SCHRAMM; 12/04/2018 – Rep. Roby: Roby Highlights Visits to Fort Rucker and Maxwell-Gunter Air Force Base on House Floor; 22/04/2018 – DJ Maxwell Technologies Inc, Inst Holders, 1Q 2018 (MXWL); 16/03/2018 – 18th Annual Soul Beach Music Festival Hosted by Aruba Announces High Voltage Headliners: Alicia Keys, Maxwell & Marlon Wayans; 27/03/2018 – U.S. SEC SAYS MAXWELL TECHNOLOGIES, FORMER EXECUTIVE SETTLE CHARGES OF INFLATING FINANCIAL RESULTS; 08/05/2018 – MAXWELL TECHNOLOGIES- ON MAY 8 ,CO ENTERED AMENDED & RESTATED LOAN & SECURITY AGREEMENT WHICH AMENDS, RESTATES & EXTENDS AGREEMENT DATED JULY 3, 2015; 18/04/2018 – Maxwell Technologies Sees 1Q Rev Below $31M-$33M Guidanc; 27/03/2018 – Maxwell Technologies, Former Executive Settle SEC Charges for Inflating Financial Results

Analysts await Maxwell Technologies, Inc. (NASDAQ:MXWL) to report earnings on August, 6. They expect $-0.24 earnings per share, down 14.29% or $0.03 from last year’s $-0.21 per share. After $-0.23 actual earnings per share reported by Maxwell Technologies, Inc. for the previous quarter, Wall Street now forecasts 4.35% negative EPS growth.

Maxwell Technologies, Inc. develops, makes, and markets energy storage and power delivery products worldwide. The company has market cap of $186.79 million. The firm offers ultra-capacitor cells, and multi-cell packs and modules, which provide energy storage and power delivery solutions for applications in various industries, including bus, rail, and truck in transportation; grid energy storage; and renewable wind energy solutions. It currently has negative earnings. It also provides lithium-ion capacitors, which are energy storage devices designed to address various applications in the rail, grid, and industrial markets where energy density and weight are differentiating factors.