Industry News

Industry News

Martin & Company Inc increased Mckesson Corp. (MCK) stake by 35.88% reported in 2018Q1 SEC filing. Martin & Company Inc acquired 6,203 shares as Mckesson Corp. (MCK)вҖҷs stock declined 5.64%. The Martin & Company Inc holds 23,493 shares with $3.31 million value, up from 17,290 last quarter. Mckesson Corp. now has $26.92B valuation. The stock decreased 1.77% or $2.4 during the last trading session, reaching $133.4. About 2.26M shares traded or 28.05% up from the average. McKesson Corporation (NYSE:MCK) has declined 10.19% since July 1, 2017 and is downtrending. It has underperformed by 22.76% the S&P500. Some Historical MCK News: 25/04/2018 вҖ“ McKesson Launches Multi-Year Strategic Growth Initiative; Reaffirms Fiscal 2018 Outlook, Provides Preliminary Fiscal 2019 Outlook; 25/04/2018 вҖ“ MCKESSON LAUNCHES MULTI-YEAR STRATEGIC GROWTH INITIATIVE; REAFF; 23/04/2018 вҖ“ ROBBINS LIKE EXPRESS SCRIPTS, CVS, MCKESSON AT SOHN CONF; 02/04/2018 вҖ“ Hyland completes acquisition of OneContent from Allscripts; 25/04/2018 вҖ“ MCKESSON CORP MCK.N REAFFIRMS FY 2018 ADJUSTED SHR VIEW $12.50 TO $12.80; 20/04/2018 вҖ“ McKesson: Management Worked to Meet DEAвҖҷs Expectations for Controlled-Substances Monitoring Program; 24/05/2018 вҖ“ McKesson: Complaint Alleges Repackage, Sale of Syringes in Violation of False Claims Act, Other Statutes; 20/04/2018 вҖ“ MCKESSON: CMTE RECOMMENDS ENHANCED OVERSIGHT RELATED TO OPIOIDS; 15/05/2018 вҖ“ MCKESSON BOARD ACCUSED OF FAILING TO OVERSEE OPIOID SHIPMENTS; 25/04/2018 вҖ“ McKesson Launches

Comprehensive Review of Operations

Analysts expect The Timken Company (NYSE:TKR) to report $1.09 EPS on July, 25.They anticipate $0.41 EPS change or 60.29% from last quarterвҖҷs $0.68 EPS. TKRвҖҷs profit would be $84.57M giving it 9.99 P/E if the $1.09 EPS is correct. After having $1.01 EPS previously, The Timken CompanyвҖҷs analysts see 7.92% EPS growth. It closed at $43.55 lastly. It is down 7.38% since July 1, 2017 and is uptrending. It has underperformed by 5.19% the S&P500. Some Historical TKR News: 19/03/2018 вҖ“ TIMKEN CO TKR.N SEES FY 2018 GAAP SHR $3.35 TO $3.45; 01/05/2018 вҖ“ Timken Raises FY18 View To EPS $3.80-EPS $3.90; 21/05/2018 вҖ“ INDIAвҖҷS TIMKEN INDIA LTD TIMK.NS вҖ“ MARCH QTR NET PROFIT AFTER TAX 237 MLN RUPEES VS PROFIT 257.1 MLN RUPEES YR AGO; 08/05/2018 вҖ“ TIMKEN CO TKR.N SETS QUARTERLY CASH DIVIDEND OF $0.28/SHR; 24/05/2018 вҖ“ Timken Presenting at KeyCorp Conference May 30; 19/03/2018 вҖ“ Timken Expects Sales to Be Up 12% to 13 % in 2018; 21/05/2018 вҖ“ TIMKEN INDIA LTD TIMK.NS вҖ“ RECOMMENDED DIVIDEND OF 1 RUPEE PER SHARE; 01/05/2018 вҖ“ Timken 1Q Net $80.2M; 08/05/2018 вҖ“ Timken Raises Quarter Dividend to 28c Vs. 27c; 16/04/2018 вҖ“ 2018 Mechanical Seals Procurement Global Market Report вҖ“ Key Players are Flowserve, Trelleborg, Sulzer, Timken, and John Crane вҖ“ ResearchAndMarkets.com

More notable recent McKesson Corporation (NYSE:MCK) news were published by: Seekingalpha.com which released: вҖңMcKesson: Market OverreactionвҖқ on June 29, 2018, also Seekingalpha.com with their article: вҖңMcKesson: Attractive At $150вҖқ published on June 18, 2018, Schaeffersresearch.com published: вҖңHistory Says Buy the Dip on This Amazon RivalвҖқ on June 28, 2018. More interesting news about McKesson Corporation (NYSE:MCK) were released by:Bizjournals.com and their article: вҖңUber poaches new real estate head from McKessonвҖқ published on June 29, 2018 as well as Globenewswire.comвҖҳs news article titled: вҖңInvestor Expectations to Drive Momentum within CenterPoint Energy, Univar, NOW, McKesson, Brinker International вҖҰвҖқ with publication date: June 27, 2018.

Investors sentiment increased to 0.9 in Q1 2018. Its up 0.11, from 0.79 in 2017Q4. It increased, as 73 investors sold MCK shares while 263 reduced holdings. 73 funds opened positions while 230 raised stakes. 178.18 million shares or 0.22% more from 177.79 million shares in 2017Q4 were reported. Regentatlantic Lc reported 0.06% of its portfolio in McKesson Corporation (NYSE:MCK). Kentucky Retirement System stated it has 0.13% of its portfolio in McKesson Corporation (NYSE:MCK). Stratos Wealth Prns Limited reported 0.17% stake. Tradewinds Capital Mngmt holds 0.04% or 571 shares. Illinois-based First Midwest Fincl Bank Tru Division has invested 0.37% in McKesson Corporation (NYSE:MCK). West Oak Ltd Liability Com holds 0% or 400 shares. Fincl Architects Inc owns 475 shares or 0.01% of their US portfolio. 51,000 were accumulated by Schwerin Boyle Mgmt. Thomas Story And Son Ltd accumulated 1,500 shares. New York-based Mutual Of America Capital Mgmt Ltd Com has invested 0.06% in McKesson Corporation (NYSE:MCK). Fukoku Mutual Life Insur owns 1,060 shares for 0.02% of their portfolio. 141 are held by Delta Asset Management Ltd Tn. Stifel Financial invested in 13,436 shares or 0.01% of the stock. 57,800 are owned by Alpine Woods Invsts Lc. Minnesota-based Carlson Cap has invested 0.12% in McKesson Corporation (NYSE:MCK).

Since March 1, 2018, it had 0 insider buys, and 2 sales for $334,327 activity. Lampert Erin M had sold 868 shares worth $123,256 on Wednesday, May 30.

Martin & Company Inc decreased The Boeing Co. (NYSE:BA) stake by 7,955 shares to 5,460 valued at $1.79M in 2018Q1. It also reduced McdonaldвҖҷs Corp. (NYSE:MCD) stake by 12,848 shares and now owns 9,177 shares. Fedex Corp. (NYSE:FDX) was reduced too.

Among 10 analysts covering McKesson (NYSE:MCK), 6 have Buy rating, 0 Sell and 4 Hold. Therefore 60% are positive. McKesson had 12 analyst reports since January 5, 2018 according to SRatingsIntel. The firm earned вҖңBuyвҖқ rating on Wednesday, January 24 by Jefferies. Cowen & Co maintained it with вҖңBuyвҖқ rating and $18600 target in Wednesday, April 18 report. On Friday, February 2 the stock rating was maintained by Needham with вҖңBuyвҖқ. The stock has вҖңBuyвҖқ rating by Robert W. Baird on Wednesday, January 17. The rating was maintained by RBC Capital Markets with вҖңHoldвҖқ on Thursday, February 1. The firm has вҖңHoldвҖқ rating by Mizuho given on Thursday, February 1. The company was maintained on Tuesday, May 29 by Leerink Swann. Mizuho maintained the shares of MCK in report on Wednesday, January 24 with вҖңHoldвҖқ rating. On Wednesday, April 11 the stock rating was maintained by Bank of America with вҖңBuyвҖқ.

More news for The Timken Company (NYSE:TKR) were recently published by: Nasdaq.com, which released: вҖңReport: Exploring Fundamental Drivers Behind MSC Industrial Direct, Timken, CoreLogic, Genesco, MoneyGram вҖҰвҖқ on June 28, 2018. Investorplace.comвҖҳs article titled: вҖңUS Manufacturing Gathers Steam Under Trump: 5 Top PicksвҖқ and published on June 06, 2018 is yet another important article.

Among 7 analysts covering The Timken Company (NYSE:TKR), 5 have Buy rating, 1 Sell and 1 Hold. Therefore 71% are positive. The Timken Company had 8 analyst reports since January 2, 2018 according to SRatingsIntel. The company was upgraded on Tuesday, January 2 by Longbow. The firm earned вҖңBuyвҖқ rating on Tuesday, May 29 by Stifel Nicolaus. The firm has вҖңBuyвҖқ rating by Jefferies given on Thursday, January 18. The rating was upgraded by Vertical Research to вҖңBuyвҖқ on Friday, May 4. Stifel Nicolaus maintained the stock with вҖңHoldвҖқ rating in Thursday, February 8 report. KeyBanc Capital Markets upgraded it to вҖңOverweightвҖқ rating and $54 target in Wednesday, June 27 report. The stock has вҖңUnderperformвҖқ rating by Bank of America on Tuesday, May 22.

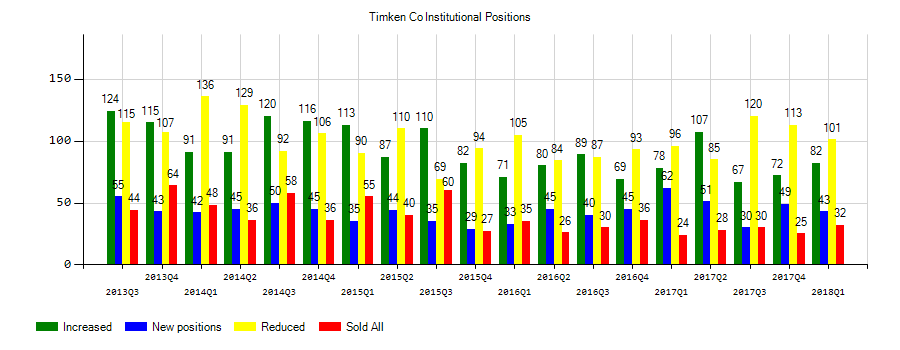

Investors sentiment increased to 0.94 in 2018 Q1. Its up 0.06, from 0.88 in 2017Q4. It is positive, as 32 investors sold The Timken Company shares while 101 reduced holdings. 43 funds opened positions while 82 raised stakes. 58.66 million shares or 1.14% less from 59.34 million shares in 2017Q4 were reported. Cornercap Counsel stated it has 0.11% of its portfolio in The Timken Company (NYSE:TKR). Stratos Wealth Partners Limited stated it has 477 shares or 0% of all its holdings. Fulton National Bank & Trust Na holds 0.02% or 4,964 shares in its portfolio. Hm Payson & holds 0.01% or 4,480 shares in its portfolio. 6,005 were reported by Coastline Trust Co. Advantus Incorporated accumulated 8,412 shares or 0.01% of the stock.

Point72 Asset Management Limited Partnership has 0.03% invested in The Timken Company (NYSE:TKR). Peoples Fincl owns 60 shares. Fincl Bank Of Montreal Can holds 0% or 2,154 shares in its portfolio. Clearbridge Invests Limited Company reported 1,000 shares stake. First Interstate Natl Bank owns 100 shares or 0% of their US portfolio. Luminus Mngmt Ltd Liability has invested 0.09% in The Timken Company (NYSE:TKR). 11,070 were reported by Gsa Cap Prns Llp. The New York-based State Teachers Retirement System has invested 0.01% in The Timken Company (NYSE:TKR). Highbridge Management Ltd Llc reported 0.01% in The Timken Company (NYSE:TKR).

The Timken Company engineers, manufactures, and markets bearings, transmissions, gearboxes, belts, chains, couplings, and related products worldwide. The company has market cap of $3.38 billion. It operates through two divisions, Mobile Industries and Process Industries. It has a 13.96 P/E ratio. The Mobile Industries segment offers a portfolio of bearings, seals, lubrication devices, and systems, as well as power transmission components, engineered chains, augers, belts, and related products and maintenance services to original equipment manufacturers and end users of off-highway equipment, such as agricultural, construction, mining, outdoor power equipment, and powersports markets; and on-highway vehicles, including passenger cars, light trucks, and medium- and heavy-duty trucks, as well as rail cars and locomotives.