Machine shops and other manufacturers’ capital equipment purchases increased for the third consecutive month, to $428.32 million.

U.S. machine shops and other manufacturers’ new orders for capital equipment increased for the third consecutive month in October, rising to $428.32 million, according to the latest U.S. Manufacturing Technology Orders Report. The new figure represents a 6.3% increase over the September total and a 21.0% increase over the October 2016 result.

Through 10 months of 2017, the USMTO shows new orders for machine tools total $3.6 billion now, up 7.6% versus the January-October 2016 total.

AMT – the Assn. for Manufacturing Technology issues the monthly USMTO report that summarizes actual totals for machine tool sales, nationwide and within six regions. The figures are reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

In detail, AMT noted that there is particular strength in medical-equipment manufacturing. On the other hand, orders from manufacturers of aerospace products declined from September, and orders from the off-road equipment industry also showed weakness.

Overall, the current expansion of new orders has been long in development, and indicates manufacturers’ long-term confidence in future production volumes, based on their current and expected production volumes.

“Growth is likely to remain positive for capital-equipment investment as manufacturers leverage new technology to stay competitive, and our members have reported strong quotation activity for the last 60 days,” stated AMT president Douglas K. Woods. “In addition, export growth has continued while imports have fallen, increasing the demand for U.S.-made products both at home and abroad.”

AMT cited steady gains in the Institute for Supply Management’s monthly Purchasing Managers Index, durable goods orders, and several consecutive months of “strong consumer sentiment” as more proof of manufacturing strength.

In the Northeast region, new orders for meta-cutting machinery fell 6.1% from September to October, to $64.65 million, though that is still 14.8% higher than the October 2016 total. For the current year to-date, Northeast regional manufacturing technology orders total $623.5 million, or 5.1% less than the 10-month total for 2016.

Manufacturers’ new orders for meta-cutting machinery in the Southeast region also declined from September, down 12.0% to $47.28 million. That also represents a 7.1% decline from October 2016. Through October, the regional total for all manufacturing technology orders is $439.3 million, down 7.6% versus the comparable figure for 2016.

In the North Central-East, new orders for meta-cutting machinery totaled $110.6 million, a 36.7% rise over September’s result and a 20.5% increase over October 2016 orders. For the January-October period of 2017, the North Central-East region has posted total manufacturing technology new orders of $905.6 million, which is 8.7% higher than last year’s 10-month total.

North Central-West regional manufacturers ordered $79.6 million worth of meta-cutting machinery, 19.6% less than the September total, but 24.7% more than the October 2016 total. For the year to-date, the region’s manufacturers have ordered $672 million worth of manufacturing technology capital equipment, which is 10.3% more than their comparable total for 2016.

In the South-Central region, new orders for meta-cutting machinery rose 32.2% from September to $41.92% during October, and that signifies a 158.3% increase over the October 2016 new-order total. For the January-October 2017 period, the region’s manufacturers have ordered $343.38 million worth of manufacturing technology equipment, increasing their total over last year’s comparable figure by 62.2%.

U.S. machine shops and other manufacturers’ new orders for capital equipment increased for the third consecutive month in October, rising to $428.32 million, according to the latest U.S. Manufacturing Technology Orders Report. The new figure represents a 6.3% increase over the September total and a 21.0% increase over the October 2016 result.

Through 10 months of 2017, the USMTO shows new orders for machine tools total $3.6 billion now, up 7.6% versus the January-October 2016 total.

AMT – the Assn. for Manufacturing Technology issues the monthly USMTO report that summarizes actual totals for machine tool sales, nationwide and within six regions. The figures are reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

In detail, AMT noted that there is particular strength in medical-equipment manufacturing. On the other hand, orders from manufacturers of aerospace products declined from September, and orders from the off-road equipment industry also showed weakness.

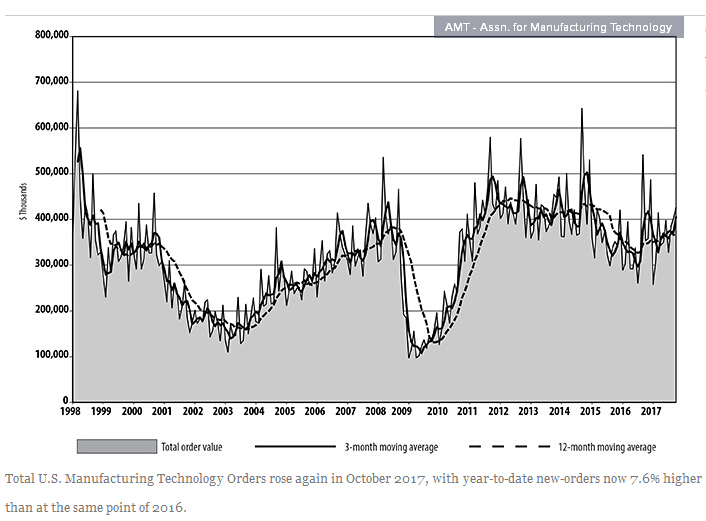

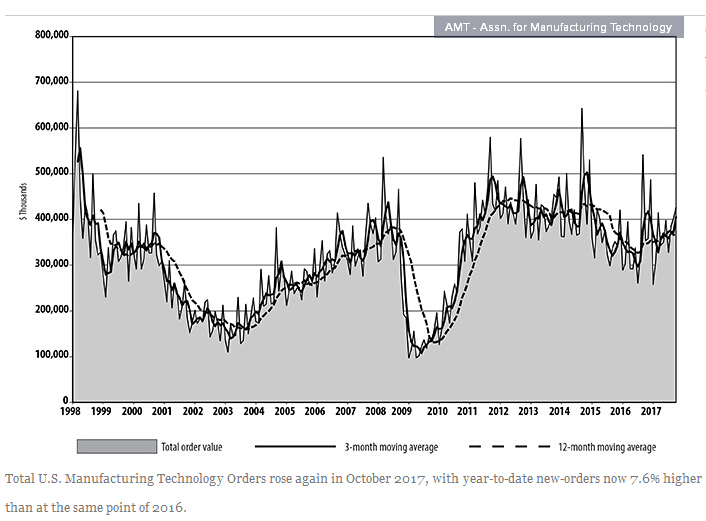

AMT - Assn. for Manufacturing TechnologyUSMTO Oct 2017 graph

Total U.S. Manufacturing Technology Orders rose again in October 2017, with year-to-date new-orders now 7.6% higher than at the same point of 2016.

Overall, the current expansion of new orders has been long in development, and indicates manufacturers’ long-term confidence in future production volumes, based on their current and expected production volumes.

“Growth is likely to remain positive for capital-equipment investment as manufacturers leverage new technology to stay competitive, and our members have reported strong quotation activity for the last 60 days,” stated AMT president Douglas K. Woods. “In addition, export growth has continued while imports have fallen, increasing the demand for U.S.-made products both at home and abroad.”

AMT cited steady gains in the Institute for Supply Management’s monthly Purchasing Managers Index, durable goods orders, and several consecutive months of “strong consumer sentiment” as more proof of manufacturing strength.

In the Northeast region, new orders for meta-cutting machinery fell 6.1% from September to October, to $64.65 million, though that is still 14.8% higher than the October 2016 total. For the current year to-date, Northeast regional manufacturing technology orders total $623.5 million, or 5.1% less than the 10-month total for 2016.

Manufacturers’ new orders for meta-cutting machinery in the Southeast region also declined from September, down 12.0% to $47.28 million. That also represents a 7.1% decline from October 2016. Through October, the regional total for all manufacturing technology orders is $439.3 million, down 7.6% versus the comparable figure for 2016.

In the North Central-East, new orders for meta-cutting machinery totaled $110.6 million, a 36.7% rise over September’s result and a 20.5% increase over October 2016 orders. For the January-October period of 2017, the North Central-East region has posted total manufacturing technology new orders of $905.6 million, which is 8.7% higher than last year’s 10-month total.

North Central-West regional manufacturers ordered $79.6 million worth of meta-cutting machinery, 19.6% less than the September total, but 24.7% more than the October 2016 total. For the year to-date, the region’s manufacturers have ordered $672 million worth of manufacturing technology capital equipment, which is 10.3% more than their comparable total for 2016.

In the South-Central region, new orders for meta-cutting machinery rose 32.2% from September to $41.92% during October, and that signifies a 158.3% increase over the October 2016 new-order total. For the January-October 2017 period, the region’s manufacturers have ordered $343.38 million worth of manufacturing technology equipment, increasing their total over last year’s comparable figure by 62.2%.

Lastly, in the West region, new orders for meta-cutting machinery rose 17.0% from September to $73.45 million, which is 28.2% higher than the October 2016 regional new-order total. Through 10 months of 2017, West regional manufacturers have ordered $634.49 million worth of new manufacturing technology equipment, 10.1% higher than their January-October 2016 total.

“Expectations are that the improving market will finish with a strong fourth quarter and easily transition into 2018,” AMT’s Woods added.

Industry News

Industry News