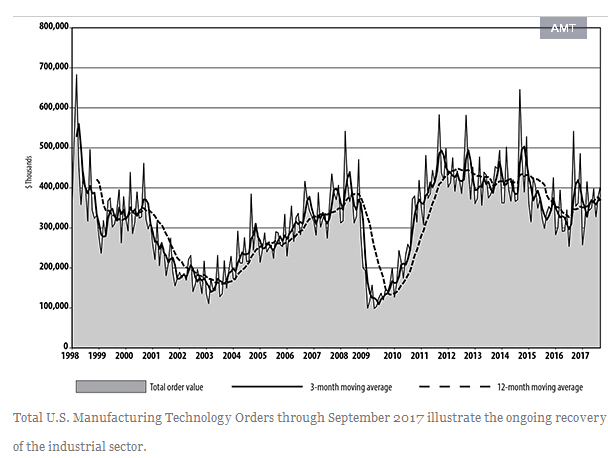

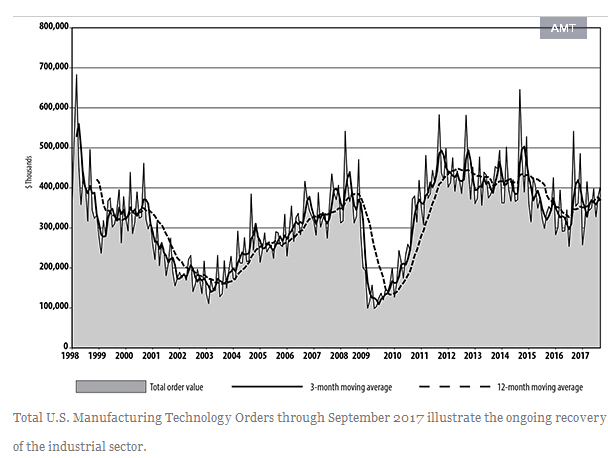

U.S. manufacturers’ demand topped $400 million during September, passing $3 billion YTD

U.S. manufacturers ordered $403.05 million worth of new machine tools during September, the second consecutive monthly increase in the U.S. Manufacturing Technology Orders index, and more evidence of the expansion trend in the domestic industrial sector. Even more significant: the latest figures indicate a 6.1% rise over the September 2016 new-order total — the period that includes orders concurrent with IMTS 2016.

With year-to-date orders totaling $3,184.65 million, the January-September total is now 5.4% higher than the comparable nine-month period of 2016.

Related: U.S. Cutting Tool Consumption Up 7.0 % YTD

AMT – the Assn. for Manufacturing Technology issues the monthly USMTO report that summarizes actual totals for machine tool sales, nationwide and in six regions. The figures are reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

The increase in orders is not evenly distributed: The North Central-East and South-Central regions reported a month-over-month decrease in orders, and only the North Central-West region stands ahead of its respective September 2016 total. More than this, the Northeast and Southeast regions are tracking below their respective 2016 year-to-date total. In short, the overall increase in machine tool orders is not due to improvements in any particular region or industrial sector, but to widespread increases in manufacturing activity prompting machine shops and other manufacturers to invest in future production programs.

Related: US Machine Tool Demand Continues to Grow

In the Northeast region, new orders for metal-cutting machines totaled $69.6 million during September, rising 9.0% from August and yet 27.5% lower than the September 2016 result. Through nine months of 2017, the Northeast’s total new orders for machine tools stands at $556.99 million, which is 7.2% lower than January-September total for 2016.

The Southeast region reported September new orders for metal-cutting machinery at $48.14 million, 12.6% higher than the August total but 40.6% lower than the September 2016 total. For the year to-date, the Southeast region reports total machine-tool new orders at $391.23 million, 9.0% lower than last year’s comparable figure.

The North Central-East region’s new orders for metal-cutting machines fell 8.5% from August to $82.04 million for September. That figure is 34.4% lower than the September 2016 regional result, but total manufacturing technology orders in the region have risen to $790.54 million through September, 6.7% higher than the 2016 nine-month total.

In the North Central-West, new orders for metal-cutting machinery totaled $99.01 million, a rise of 49.4% from August and of 19.6% from September 2016. For the January-September period, total new orders in the region are up to $589.99 million, or 10.1% higher than the comparable figure for 2016.

The South-Central region’s new orders for metal-cutting equipment were reported at $31.99 million, 32.5% lower than the August result and 25.6% lower than the September 2016 figure. For the year to-date, the South Central’s total new machine-tool orders are at $300.38 million, up 53.6% over last year’s nine-month figure.

The West region reported September new orders for metal-cutting equipment at $62.78 million, 10.6% higher than the August result but 37.8% lower than last year’s September figure. For the January-September 2017 period, the West region has reported machine-tool new orders totaling $555.51. million, which is 7.0% higher than 2016’s comparable total.

Industry News

Industry News